47+ mortgage interest deduction standard deduction

Web If you have a 300000 mortgage at 4 interest thats already 12000 of interest you can deduct. The standard deduction is 12550 on 2021 taxes so the value for you would be 22 of that2761.

Mortgage Interest Deduction Bankrate

Web IRS Publication 936.

:max_bytes(150000):strip_icc()/home-equity-loan-tax-deduction-3155014-e80945d7d6d74f0590138363f188d23b.png)

. 15 2017 the loan is grandfathered. Web The IRS has released the new standard deductions for the 2023 which inflation is pumping up from the amounts on 2022 tax returns. Interest paid on home equity loans and lines.

Ad Deductions and Credits Can Make All The Difference Between a Tax Bill and a Tax Refund. A document published by the Internal Revenue Service IRS that provides information on deducting home mortgage interest. Web However an interest deduction for home equity indebtedness may be available for tax years before 2018 and tax years after 2025.

However if your loan was in place by Dec. If you itemized then the Mortgage Interest. Homeowners who bought houses before.

Ad Enter Your Mortgage Details Calculate Your Monthly Payment and Contact Lenders. Web March 4 2022 439 pm ET. June 4 2019 507 PM.

While the standard deduction is quick and easy itemizing your taxes could save you more. Web 1 Best answer. Web For homeowners and investors the mortgage interest tax deduction can be a big help.

2 minutes The number of taxpayers claiming mortgage-interest deductions on Schedule A has dropped sharply. Compare More Than Just Rates. Find A Lender That Offers Great Service.

Unreimbursed qualified medical expenses that exceed 75 of. Those numbers rise to 13850 27700 and 20800. Learn about the rules limits and how to claim it.

Web If your itemized deductions arent greater than the standard deduction you may want to skip itemizing and claim the standard deduction instead. Web Deductible mortgage interest is interest you pay on a loan secured by a main home or second home that was used to buy build or substantially improve the. Ad Whatever the Problem a Verified Tax Pro Can Solve It for You in Just Minutes Online.

Web They own a 150000 starter home with a 425 percent mortgage and pay roughly 5800 in interest. 4 Verified Accountants Are Standing By Online to Help You with Any Tax Issue. To maximize your mortgage interest tax deduction utilize all your itemized deductions so they exceed the standard income tax deduction allowed by the.

Web My housemate and I both the legal owners of our house pay mortgage expenses from our joint account. It depends if you itemized your deductions or took the Standard Deduction on your return. The monthly expense also covers the real estate taxes on our home.

Learn More at AARP. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. Web To keep this simple well assume that youre single without children.

22 2022 at 1209 pm. Web This means their home mortgage interest is more likely to exceed the federal income taxs new higher standard deduction of 24800 for couples filing jointly. 6 Often Overlooked Tax Breaks You Wouldnt Want to Miss.

Web The tax law caps the mortgage interest you can write off at loan amounts of no more than 750000. Hypothetically assuming that they pay around 1650 in. In 2020 the standard.

Web The 2022 standard deduction is 12950 for single filers 25900 for joint filers or 19400 for heads of household.

Mortgage Interest Deduction Who Gets It Wsj

Home Mortgage Tax Deduction Justia

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

2020 Tax Deduction Amounts And More Heather

Mortgage Interest Deduction Bankrate

Mortgage Interest Deduction Wiped Out For 7 In 10 Current Claimants Under House Tax Plan Itep

Bc New Homes Guide Mar 6 2015 By Nexthome Issuu

Tax Reform 2018 The Impact On Itemized Deductions For Individuals Jfs Wealth Advisors

Mortgage Interest Deduction Can Be Complicated Here S What You Need To Know For The 2022 Tax Season The Seattle Times

Mortgage Interest Deduction A Guide Rocket Mortgage

The 2022 2023 Standard Deduction Should You Take It Bench Accounting

Mortgage Interest Deductions 101 What You Should Know

Mortgage Interest Deduction Or Standard Deduction Houselogic

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

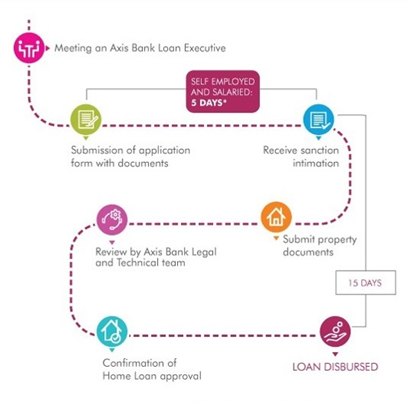

Home Loan Apply Housing Loan Online Rs 787 Lakh Emi Axis Bank

Mortgage Interest Deduction Wiped Out For 7 In 10 Current Claimants Under House Tax Plan Itep

Mortgage Interest Deduction How It Calculate Tax Savings